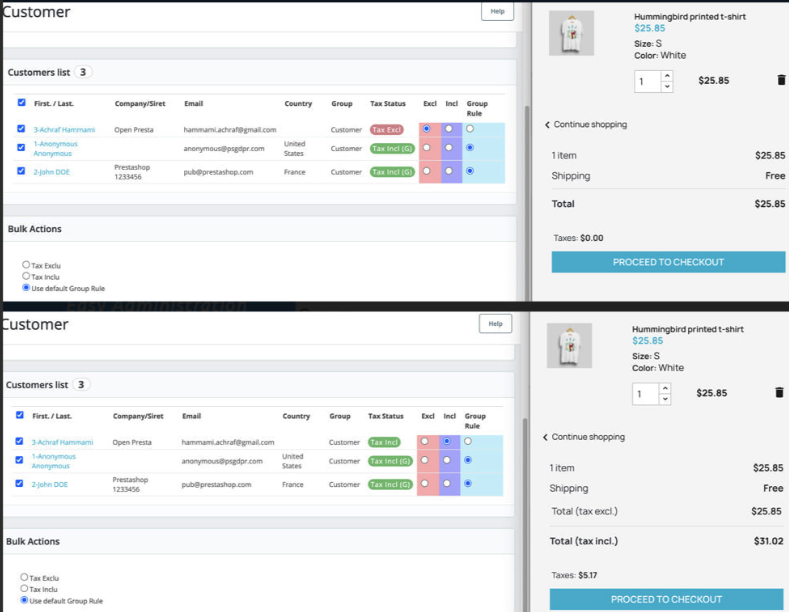

When working with consumers, prices are usually expressed with taxes included in the price (e.g., in most eCommerce). But, when you work in a B2B environment, companies usually negotiate prices with taxes excluded.

For this reason , many of prestashop merchant need to build two store one for b2c and one for b2b. that solution will double your charge of work , need double maintenance , support and have many problem .

We propose for you easy and one solution work for your one prestashop ?

install our best module for b2b and b2c tax calculation for addons prestashop

with our module you can active tax calculaton for one customer or for group of customer , without any core modification , you keep your shop clean and work for b2b and b2c.

If you negotiate a contract with a customer, whether you negotiate tax included or tax excluded, you can set the rule and the fiscal position on the customer form so that it will be applied automatically at every sale of this customer.